News and

Insights

Keep up to date with Plenitude and industry news

- Category

- Plenitude Insights

- Industry News

- Plenitude News

- Service

- Advisory & Transformation

- S166 Skilled Person

- Digital Assets

- Technology & Data Analytics

- KYC Managed Services

- FCC Software Products

- RegSight

- Compass

- ClientSight

- RiskSight

- Expertise

- AML/CTF/CPF

- Sanctions

- Fraud

- Tax Evasion

- Market Abuse

- Bribery & Corruption

- Sector

- Retail Banking

- EML/PSP/Fintech

- Digital Assets/Crypto

- Wealth Management & Private Banking

- Capital Markets/Investment Banking

- Insurance

- Asset Management

- Consumer Finance

- Corporate Finance

- Pensions

Industry News

14 March 2025

OFSI Updates Guidance for High-Value Dealers and Art Market Participants

Industry News

14 March 2025

The UK Government announced the disbandment of the Payment Systems Regulator

Industry News

07 March 2025

FATF Launches Consultation on Proliferation Financing & Sanctions Evasion

Industry News

28 February 2025

FATF Launches Second Consultation on Payment Transparency Rule Changes

Industry News

14 February 2025

Transparency International Releases 2024 Corruption Perceptions Index

Industry News

31 January 2025

UK Government Released a Policy Paper for Companies House following The ECCTA

Industry News

31 January 2025

The FCA released the results of a multi-firm review into firms’ use of the National Fraud Database

Industry News

24 January 2025

EBA & ESMA Report on DeFi and Crypto-Asset Trends in Lending & Staking

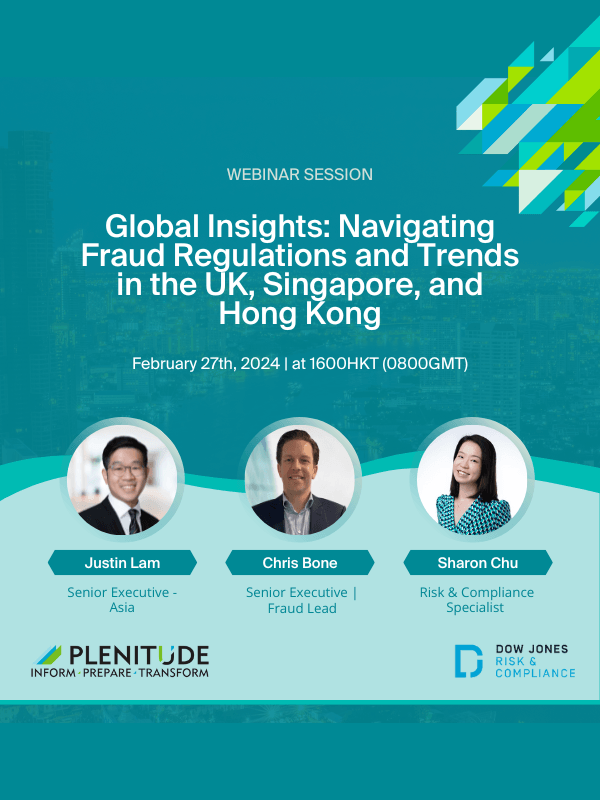

Plenitude News

17 January 2025

WEBINAR: From Fines to Fixes: Compliance Insights from Recent Enforcement Actions

Industry News

10 January 2025

UK Introduces Interim Serious Crime Orders in New Border Security Bill

Industry News

03 January 2025

Europol Report on Criminal Networks Abuse of Legal Business Structures

Industry News

03 January 2025

RUSI Report on Whistleblower Rewards' Programme on Fighting Economic Crime

Industry News

13 December 2024

FCA Launches Consultation on Increasing Transparency of Enforcement Investigations

Plenitude Insights

10 December 2024

PLENITUDE INSIGHTS: RegIntel - 2024 Recap and 2025 Outlook Report

Industry News

06 December 2024

Operation Destabilise disrupts multi-billion dollar money-laundernig networks

Industry News

06 December 2024

New Suspicious Transaction Reporting guidance released by BaFin and FIU

Plenitude News

Industry News

29 November 2024

New project to tackle money laundering launched by Plenitude, Alan Turing Institute, Napier AI and FCA

Industry News

14 November 2024

EBA publishes guidelines on internal policies, procedures and controls on restrictive measures

Industry News

14 November 2024

UK Finance responds to Bank of England paper on Innovation in Money and Payments

Industry News

18 October 2024

The Technology Working Group report on the application of AI in UK's Investment Industry

Industry News

18 October 2024

Singapore's joint warning on rise of government official impersonations

Industry News

10 October 2024

Singapore's Consultation Paper on Proposed Regulatory Approach for DTSPs

Plenitude Insights

Industry News

04 October 2024

Plenitude discuss APP Reimbursement Rules with Threat Fabric

Plenitude Insights

Industry News

04 October 2024

Semoto Podcast features Plenitude's Manuel Fajardo, discussing global crypto regulation

Industry News

26 September 2024

More consistent and effective AML supervision required, OPBAS review states

Industry News

13 September 2024

Wolfsberg Group's Response on Regulating and Supervising Cross-border Payment Services and Data Frameworks Alignment

Industry News

02 September 2024

Transparency International report on Money Laundering through E-Payments

Industry News

23 August 2024

NCA publishes National Strategic Assessment of Serious and Organised Crime 2024

Plenitude News

21 August 2024

WEBINAR: Unlocking AI's Role in Fraud & Financial Crime: Best Practices in Explainability & Governance

Industry News

16 August 2024

Deadline for PSPs to Register Ahead of APP Reimbursement Rule Approaching

Industry News

02 August 2024

PSFA publishes the Professional Standard for Fraud Intelligence Practitioner

Plenitude Insights

Plenitude News

09 February 2024

Plenitude DE&I Council Recognised in Manage HR Article

Industry News

30 January 2024

Transparency International Published 2023 Corruption Perceptions Index

Plenitude Insights

11 January 2024

PLENITUDE INSIGHTS: RegIntel - 2023 Recap and 2024 Outlook Report

Industry News

07 November 2023

Final Beneficial Ownership Information Reporting Rule Issued by FinCEN

07 October 2023

IMF's Paper on Cryptoasset policies

24 August 2023

Money Laundering Risk Analysis Guidance by FINMA

30 July 2023

MAS's Paper on Single Family Offices

03 July 2023

PLENITUDE INSIGHTS: Navigating the Travel Rule

17 April 2023

Guidance Provided on Beneficial Ownership Reporting

27 March 2023

UK and EU Sign MOU on Financial Services

16 March 2023

FCA Publishes a Dear CEO Letter to Payment Firms

Industry News

23 February 2023

OFSI Updates Guidance on Monetary Penalties for Breaches of Sanctions

Plenitude Insights

16 November 2022

PLENITUDE INSIGHTS: Integrate Proliferation Financing into Risk Control

Plenitude Insights

24 October 2022

PLENITUDE INSIGHTS : Reflections From Orel Garcia, Junior Consultant

Plenitude Insights

18 October 2022

PLENITUDE INSIGHTS: Crypto - Understanding the Opportunities and Risks

30 September 2022

PLENITUDE INSIGHTS: Black History Month

30 April 2022

New Paper on FIs Name Screening Approach Outlined by MAS

Plenitude Insights

29 April 2021

PLENITUDE INSIGHTS: EBA Opinion on ML/TF Risk for Banking Institutions

Plenitude Insights

26 January 2021

PLENITUDE INSIGHTS: Opinion on FCA's Dear CEO Letter to Retail Banks

21 June 2019

PLENITUDE INSIGHTS: DNFBPs and Financial Crime

Plenitude Insights

29 October 2018

PLENITUDE INSIGHTS: FCC Target Operating Model and Transformation

No results found…

Get in touch to speak to the team or to request a demo

Our best-in-class team are committed to building a secure financial system, safeguarding society, and empowering our clients to meet their regulatory obligations.

Contact Us

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(1).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(2).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(3).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(5).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(6).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(7).jpg)