AI Assurance Services

In AI We Trust makes the case for a new FCC model - one where human judgement is elevated, not side-lined, and where trust isn't an afterthought. We design with trust, verification, explainability, and meaningful human oversight from the very start, ensuring systems are resilient, transparent, and built for the real world.

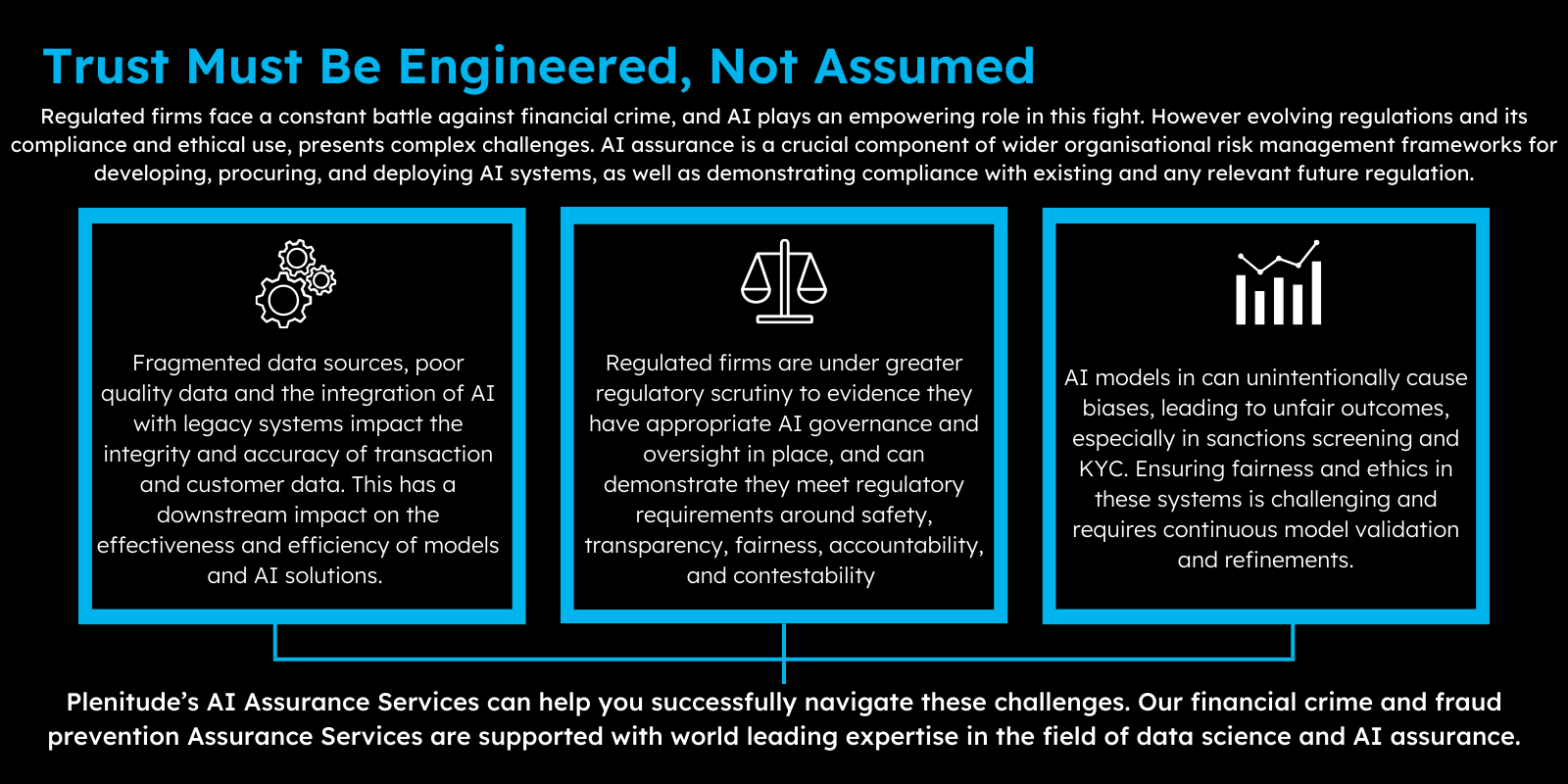

AI in financial crime and fraud prevention has become a strategic priority for firms, driven largely by the transformative opportunities unlocked by AI, which present compelling benefits in terms of increased operational efficiency and more effective risk management.

The Artificial Intelligence and Machine Learning Survey from the Bank of England and FCA last November found the highest perceived current benefits are in data and analytical insights, anti-money laundering (AML) and combating fraud, and cybersecurity. The areas with the largest expected increase in benefits over the next three years are operational efficiency, productivity, and cost base.

.png?width=600&height=400&name=Untitled%20design%20(4).png)

However, the same report found 75% of firms are already using AI — yet only 34% fully understand how it works. The risks that are expected to increase the most over the next three years are third-party dependencies, model complexity, and embedded or ‘hidden’ models.

-1.png?width=1600&height=800&name=AI%20Assurance%20(2)-1.png)

Our AI Assurance Services

Our financial crime and fraud prevention AI Assurance Services are supported with world leading expertise in the field of data science and AI assurance.

A key component of our approach is the assessment and development of the supporting governance, oversight and control framework required to effectively identify, assess, monitor and manage risks.

Our services can be delivered pre or post deployment and will provide assurance that outputs and performance meet expectations and regulatory requirements.

-

AI Risk & Control Assessment

Diagnosis of AI risks stemming from organisation, system, and model layers. Assessment and development of controls to mitigate risks within appetite.

-

AI Operating Model Setup

Design and delivery of AI assurance operating model tailored to your risk appetite. AI compute infrastructure requirements.

-

Ongoing Monitoring

Ongoing monitoring of systems including predictive risk alerts based on data collection.

-

Vendor AI Solution Review

Review and assure third-party AI vendor solutions to ensure they meet your firm's risk and compliance standards, providing confidence in the integrity and performance of vendor AI models.

-

Data Readiness & Robustness Evaluation

Evaluate the quality of data used in AI models, which is crucial for achieving reliable and unbiased outputs in financial crime detection.

-

Red-teaming and stress-testing

Red-teaming and stress-testing of human-AI workflows.

Find out more about our AI Assurance Services, by reading our brochure.

Benefits and Outcomes Delivered

We empower regulated firms like yours to:

-

Accelerated AI Deployment with Confidence

Reduce risk, increase explainability, and secure internal stakeholder trust so AI systems can move from proof-of-concept into production faster, delivering operational benefits sooner.

-

Regulatory Readiness and Compliance

Provide defensible assurance that AI models meet evolving regulatory requirements for safety, transparency, fairness, accountability, and contestability—standing up to scrutiny from boards, auditors, and supervisors.

-

Improved Effectiveness of Financial Crime Controls

Deploy validated, explainable AI models that outperform manual or rule-based systems, enabling proactive detection and disruption of criminal activity.

-

Reduced Operational and Reputational Risk

Identify and mitigate failure points in AI-driven FCC systems before deployment through adversarial testing, bias mitigation, and continuous monitoring.

-

Enhanced Transparency and Auditability

Embed traceability into AI workflows, with full logs of decisions, overrides, and escalations, enabling clear oversight for internal audit, regulators, and senior management.

-

Workforce Transformation and Human Elevation

Redesign compliance roles for a post-AI environment, shifting human expertise toward judgment, escalation, and strategic oversight, while automating repetitive, low-value tasks.

Our specialists

Louise Brett

CEO

Alan Paterson

Chief Innovation Officer

.png)

Paul Freeman

Interim Chief Operating Officer

.jpg)

Paul Mclear

Director

Stratis Limnios

Manager

Lukasz Szpruch

Senior Technical Advisor

Carsten Maple

Senior Technical Advisor

Related articles

Get in touch to speak to the team or to request a demo

Our best-in-class team are committed to building a secure financial system, safeguarding society, and empowering our clients to meet their regulatory obligations.

Contact Us