News and

Insights

Keep up to date with Plenitude and industry news

- Category

- Plenitude Insights

- Industry News

- Plenitude News

- Service

- Advisory & Transformation

- S166 Skilled Person

- Digital Assets

- Technology & Data Analytics

- KYC Managed Services

- FCC Software Products

- RegSight

- Compass

- ClientSight

- RiskSight

- Expertise

- AML/CTF/CPF

- Sanctions

- Fraud

- Tax Evasion

- Market Abuse

- Bribery & Corruption

- Sector

- Retail Banking

- EML/PSP/Fintech

- Digital Assets/Crypto

- Wealth Management & Private Banking

- Capital Markets/Investment Banking

- Insurance

- Asset Management

- Consumer Finance

- Corporate Finance

- Pensions

26 July 2024

PLENITUDE INSIGHTS: The New EU AML/CTF Package

Plenitude Insights Advisory and Transformation AML/CTF/CPF

26 July 2024

GenAI Enabled Fraud Threat Information Published by UKFIU

Fraud Advisory and Transformation Technology & Data Analytics AML/CTF/CPF Industry News

26 July 2024

MONEYVAL publishes Mutual Evaluation Report for Jersey

Sanctions Advisory and Transformation AML/CTF/CPF Industry News

26 July 2024

PSR Seek Consultation on Guidance to Identify APP Scams

Fraud Advisory and Transformation AML/CTF/CPF Industry News

19 July 2024

Consumer Duty Implementation Deadline on 31st July

Consumer Finance AML/CTF/CPF Industry News

19 July 2024

Hong Kong Consultation Results on Stablecoin Framework

Digital Assets Digital Assets/Crypto Industry News

28 June 2024

FATF's June Plenary and Its Key Outcomes

Digital Assets Digital Assets/Crypto Advisory and Transformation AML/CTF/CPF Industry News

22 May 2024

Plenitude Consulting Enhances Tech & Data with Acquisition of Contineo

Plenitude News Advisory and Transformation Technology & Data Analytics

16 May 2024

OFSI Updates Its Enforcement and Monetary Penalties Guidance

Sanctions Industry News

08 May 2024

FinCEN Issues Advisory on Detecting Illicit Transactions

Sanctions AML/CTF/CPF Industry News

08 May 2024

PSR Consultation on APP Scam Reimbursement for CHAPS Participants

Fraud Advisory and Transformation Industry News

08 May 2024

OFSI's New Financial Sanctions FAQs

Sanctions Advisory and Transformation Industry News

07 May 2024

HK Establishes Project to Support Tokenisation

Digital Assets Digital Assets/Crypto Industry News

01 May 2024

HM Treasury Publishes Its AML/CTF Supervision Report 2022-23

Digital Assets Retail Banking Capital Markets/Investment Banking AML/CTF/CPF Wealth Management & Private Banking Industry News

29 April 2024

EBA Opinion on New Types of Payment Fraud

Fraud Advisory and Transformation EMI/PSP/Fintech Industry News

29 April 2024

JMLSG Proposes Changes to Wholesale Markets Guidance

Capital Markets/Investment Banking Advisory and Transformation AML/CTF/CPF Industry News

26 April 2024

Wolfsberg Group Response to FATF's Amendments to Payment Transparency

AML/CTF/CPF EMI/PSP/Fintech Industry News

25 April 2024

FCA Consultation on Proposed Changes to the Financial Crime Guide

Sanctions Advisory and Transformation AML/CTF/CPF Industry News

24 April 2024

PSR's Consultation for its Supervision Approach Proposal

Fraud AML/CTF/CPF EMI/PSP/Fintech Industry News

24 April 2024

New EU Rules to Combat Money Laundering and Terrorist Financing

RegSight AML/CTF/CPF Industry News

22 April 2024

PLENITUDE INSIGHTS: Beyond Digital Assets

Plenitude Insights Digital Assets Digital Assets/Crypto AML/CTF/CPF

18 April 2024

Serious Fraud Office's Strategy for 2024-2029

Fraud Bribery & Corruption Industry News

17 April 2024

PSR Consultation on Compliance under the APP Reimbursement Requirement

Fraud Advisory and Transformation EMI/PSP/Fintech Industry News

17 April 2024

Cross-party Parliamentary Group Publishes New Economic Crime Manifesto

Fraud AML/CTF/CPF Industry News

17 April 2024

PSR Consultation on APP Reimbursement Requirement Compliance

Fraud Advisory and Transformation Industry News

15 April 2024

FinCEN Issue Notice on Use of Counterfeit US Passport Cards

Fraud Retail Banking EMI/PSP/Fintech Industry News

12 April 2024

UK & US to Clamp down on Prohibited Russian Metal Exports

Sanctions Advisory and Transformation

10 April 2024

HK Publishes the Anti-scam Consumer Protection Act

Fraud Advisory and Transformation Industry News

09 April 2024

PSR's Plan and Budget for 2024-25

Fraud Advisory and Transformation EMI/PSP/Fintech Industry News

03 April 2024

Joint Proposal to Implement Digital Securities Sandbox

Digital Assets Digital Assets/Crypto Industry News

02 April 2024

OFSI Guidance to Financial Sanctions Compliance

Sanctions Industry News

02 April 2024

Singapore to Introduce Payment Services Act Amendments

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

01 April 2024

Further Information on COSMIC Platform Published by MAS

Retail Banking AML/CTF/CPF Industry News

30 March 2024

FATF Status Report on Implementation of Recommendation 15 with VASPs

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

28 March 2024

UKFIU Publishes the SARs Annual Statistics Report

AML/CTF/CPF Industry News

28 March 2024

Export Control (Amendment) Regulations 2024 Passed

Sanctions Advisory and Transformation Industry News

28 March 2024

Introduction to AI Guide Published by PSFA

Fraud Advisory and Transformation Industry News

28 March 2024

FATF Releases Hong Kong Follow Up Report

AML/CTF/CPF Industry News

26 March 2024

NCA Confirms Arrest and 19m Seizure in Tackling Fraud Campaign

Fraud Industry News

26 March 2024

New Principles for Financial Crime Risk Management Auditing

Advisory and Transformation AML/CTF/CPF Industry News

25 March 2024

ESMA's Final Report on Draft Technical Standards for MiCA

Digital Assets Digital Assets/Crypto Industry News

25 March 2024

ESMA's Third Consultation Package under MiCA

Digital Assets Digital Assets/Crypto Market Abuse Industry News

22 March 2024

FCA's Guidance for Cryptoasset Firms to Register with the FCA

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

19 March 2024

FCA Published Business Plan for 24-25

AML/CTF/CPF Industry News

18 March 2024

FCA Published Information on Economic Crime Levy

Consumer Finance AML/CTF/CPF Industry News Insurance

12 March 2024

HK Launches Stablecoin Issues Sandbox Arrangement

Digital Assets Digital Assets/Crypto Industry News

12 March 2024

UK Publishes Near Final Payment Services Amendment Regulations 2024

Fraud EMI/PSP/Fintech Industry News

11 March 2024

New Statement on CTF from Wolfsberg Group

RegSight AML/CTF/CPF Industry News

11 March 2024

UK Open Consultation on Money Laundering Regulations Effectiveness

AML/CTF/CPF Industry News

06 March 2024

US Issues Notes on Compliance with Sanctions and Export Laws

Sanctions Advisory and Transformation Industry News

06 March 2024

UK Consultation on Cryptoasset Reporting Framework

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

05 March 2024

SRA Updates its AML/CTF Sectoral Risk Assessment

AML/CTF/CPF Industry News

05 March 2024

Dear CEO Letter Addressing AML Failings Published by FCA

Consumer Finance Advisory and Transformation AML/CTF/CPF EMI/PSP/Fintech Industry News

04 March 2024

Wolfsberg Group Updates Country Risk FAQs

Compass AML/CTF/CPF Industry News

01 March 2024

OFSI Guidance on Russian Oil Ban

Sanctions Industry News

01 March 2024

UK Aims to Tackle Money Mules with New Action Plan

Fraud Industry News

01 March 2024

FATF's Annual Report for 2022-23

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

28 February 2024

Latest Edition of SARs Report Booklet Published

Fraud Advisory and Transformation AML/CTF/CPF Industry News

27 February 2024

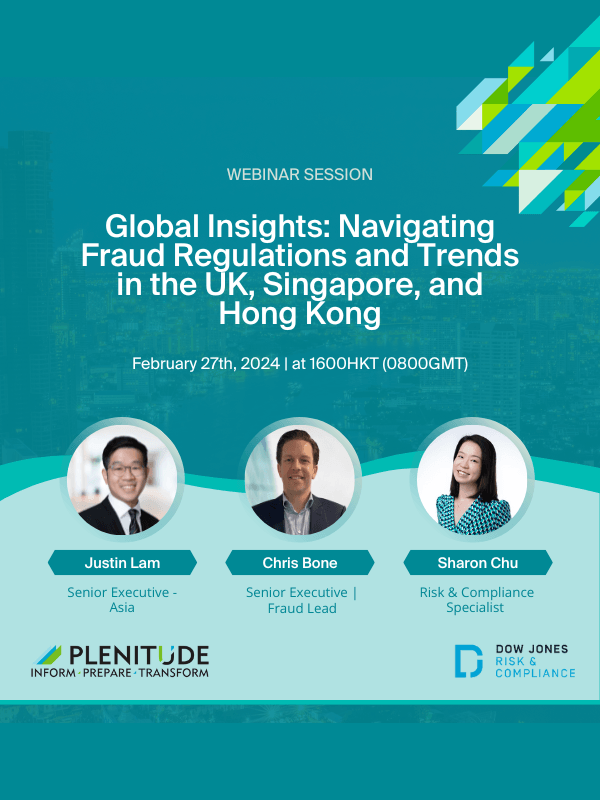

WEBINAR: Fraud Regulations in UK, Hong Kong, and Singapore

Plenitude News Fraud Advisory and Transformation

27 February 2024

Consultation Launched by FCA on Enforcement Cases Transparency

AML/CTF/CPF Industry News

23 February 2024

Key Outcomes from FATF Plenary Feb 2024

Compass AML/CTF/CPF Industry News

22 February 2024

PLENITUDE INSIGHTS: Mitigating the Risks of an S166 Review

Plenitude Insights S166 Skilled Person AML/CTF/CPF

22 February 2024

Host City for new AMLA Announced

AML/CTF/CPF Industry News

22 February 2024

Consumer Duty Guidance Published by FCA

AML/CTF/CPF Industry News

22 February 2024

New Sanctions Strategy Announced by UK

Sanctions Industry News

19 February 2024

2023 Annual Scams and Cybercrime Brief Published by Singapore Police

Fraud Advisory and Transformation Industry News

14 February 2024

FCA Releases Findings on Enforcement Actions

AML/CTF/CPF Industry News

14 February 2024

MEPs Vote for More Open Competitive Payment Services in the EU

Fraud Advisory and Transformation EMI/PSP/Fintech Industry News

13 February 2024

ESMA Clarification on Reporting Requirements under MIFID II

Market Abuse Industry News

13 February 2024

OFSI Updates its Sanctions Guidance

Sanctions Advisory and Transformation Industry News

12 February 2024

New Reporting Requirements for Designated Persons Released by OFSI

Sanctions Industry News

09 February 2024

Plenitude DE&I Council Recognised in Manage HR Article

Plenitude Insights Plenitude News

Plenitude Insights

Plenitude News

09 February 2024

Plenitude DE&I Council Recognised in Manage HR Article

08 February 2024

HK Public Consultation to Introduce Licencing Regime for VA OTC

Digital Assets Fraud Digital Assets/Crypto AML/CTF/CPF Industry News

08 February 2024

HKMA Letter on Risk-based Approach for Customer Due Diligence

AML/CTF/CPF Industry News

07 February 2024

2024 National Risk Assessment Published by the US Treasury

AML/CTF/CPF Industry News

07 February 2024

European Parliament Passes the Instant Payments Regulations

Fraud EMI/PSP/Fintech Industry News

06 February 2024

Singapore's Guidance on ML/TF Risks in Corporate Service Providers

Asset Management Retail Banking AML/CTF/CPF Wealth Management & Private Banking Industry News

01 February 2024

G7 Coalition Approach to Oil Price Cap

Sanctions Industry News

31 January 2024

2023 Review and 2024 Priorities Published by HKMA

Fraud Retail Banking Advisory and Transformation AML/CTF/CPF Industry News

30 January 2024

UK Publishes Russia Sanctions Amendments

Sanctions Industry News

30 January 2024

Transparency International Published 2023 Corruption Perceptions Index

Compass Bribery & Corruption Industry News

Industry News

30 January 2024

Transparency International Published 2023 Corruption Perceptions Index

29 January 2024

ESMA Consultation Papers on MiCA Guidelines

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

23 January 2024

UK Make Amendments to Reg 33 MLRs

Compass AML/CTF/CPF Industry News

23 January 2024

HK Launches Public Consultation on FCC Information Sharing

Technology & Data Analytics AML/CTF/CPF Industry News

23 January 2024

UK Make Amendments to Reg 33 of MLRs

AML/CTF/CPF Industry News

23 January 2024

New Sanctions Guidance on Risk Assessment Published by SRA

Sanctions Industry News

23 January 2024

HK Launches Public Consultation on Information Sharing amongst AI

Fraud Retail Banking Consumer Finance Industry News

22 January 2024

First Changes to Company Law Expected for 4th of March

AML/CTF/CPF Industry News

18 January 2024

AML Package Agreement between EU Council and Parliament

Digital Assets Retail Banking Digital Assets/Crypto AML/CTF/CPF Industry News

16 January 2024

Nasdaq's Global Financial Crime Report for 2024

Sanctions Fraud Capital Markets/Investment Banking AML/CTF/CPF Industry News

12 January 2024

Wolfsberg Group Updates Guidance on Swift RMA Due Diligence

Retail Banking AML/CTF/CPF Corporate Finance Industry News

11 January 2024

PLENITUDE INSIGHTS: RegIntel - 2023 Recap and 2024 Outlook Report

Plenitude Insights Fraud RegSight AML/CTF/CPF

Plenitude Insights

11 January 2024

PLENITUDE INSIGHTS: RegIntel - 2023 Recap and 2024 Outlook Report

11 January 2024

PSR Publishes Consultation on Proposed Revisions

AML/CTF/CPF EMI/PSP/Fintech Industry News

11 January 2024

UK Published Guidance on DAML Reporting Obligations

AML/CTF/CPF Industry News

06 January 2024

EBA Guidelines on ML/TF Risk Factors to CASPs

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

01 January 2024

EU Rules to Combat VAT Fraud

Fraud Tax Evasion Industry News

01 January 2024

FinCEN Begins Accepting Beneficial Ownership Reports

AML/CTF/CPF Industry News

27 December 2023

Joint Consultation on the Proposal to Regulate Stablecoin Issuers

Digital Assets Digital Assets/Crypto Market Abuse AML/CTF/CPF Industry News

22 December 2023

OFAC US-Russia Sanctions Guidance for Foreign Financial Institutions

Sanctions Advisory and Transformation Industry News

13 December 2023

AML Authority Established between EU Parliament and EU Council

AML/CTF/CPF Industry News

13 December 2023

AUSTRAC Regulatory priorities for 2024

AML/CTF/CPF Industry News

12 December 2023

EU Parliament and EU Council Propose New Law on Asset Recovery

AML/CTF/CPF Industry News

11 December 2023

New Unit Created by UK to Clamp down on Sanctions Evasion

Sanctions Industry News

08 December 2023

Wolfsberg Group's Response to FATF Consultation

AML/CTF/CPF Industry News

05 December 2023

IMF's 2023 Review of its AML/CTF Strategy

AML/CTF/CPF Industry News

04 December 2023

EU Council extends the EU Global Human Rights Sanctions Regime

Sanctions Industry News

01 December 2023

NCA's Red Alert on Russia's Sanctions Evasion

Sanctions Industry News

01 December 2023

FATF Follow-up Report on Germany Compliance

AML/CTF/CPF Industry News

30 November 2023

Regulatory Initiatives from the FCA for 2024-25

Digital Assets Fraud Digital Assets/Crypto AML/CTF/CPF Industry News

30 November 2023

Online Fraud Charter Published by the UK Government

Fraud Advisory and Transformation Industry News

30 November 2023

SARs Reporter Booklet for November Published

AML/CTF/CPF Industry News

22 November 2023

National Policing Strategy for Fraud, Economic, Cyber Crime Launched

Fraud Industry News

22 November 2023

FATF and OECD Joint Report on Misuse of Citizenship and Residency

AML/CTF/CPF Bribery & Corruption Industry News

17 November 2023

OFSI and FCDO Issue Guidance on Ownership and Control

Sanctions AML/CTF/CPF Industry News

16 November 2023

MAS's Consultation on the Sharing of AML/CTF Information between FIs

AML/CTF/CPF Industry News

16 November 2023

Updated Guidance for NPOs Published by the FATF

AML/CTF/CPF Industry News

16 November 2023

FATF on Recovering International Proceeds of Crime

AML/CTF/CPF Industry News

13 November 2023

PSFA Publishes Annual Report for 2022-23

Fraud Industry News

10 November 2023

EU Publishes Prominent Public Functions to Aid PEP Identification

Advisory and Transformation AML/CTF/CPF Industry News

09 November 2023

PSR Publishes Consultation Following FSMA 2023 Passing

Fraud AML/CTF/CPF EMI/PSP/Fintech Industry News

09 November 2023

'Role of MLRO' Review Published by ICAEW

AML/CTF/CPF Industry News

08 November 2023

FCA's Dear CEO Letter to Wealth Management and Stockbroking Firms

Fraud Advisory and Transformation AML/CTF/CPF Wealth Management & Private Banking Industry News

07 November 2023

Final Beneficial Ownership Information Reporting Rule Issued by FinCEN

Advisory and Transformation AML/CTF/CPF Industry News

Industry News

07 November 2023

Final Beneficial Ownership Information Reporting Rule Issued by FinCEN

06 November 2023

FCA Consultation on Regulations of Cryptoassets

Digital Assets Digital Assets/Crypto Industry News

01 November 2023

FCA Publishes Progress Made by Synthetic Data Expert Group

Technology & Data Analytics AML/CTF/CPF Industry News

31 October 2023

Authorised Push Payment Report Published by PSR

Fraud Retail Banking Advisory and Transformation Industry News

31 October 2023

FATF Report on Terrorism Financing through Crowdfunding

AML/CTF/CPF Industry News

31 October 2023

FATF's Consultation on Beneficial Ownership of Legal Arrangements

AML/CTF/CPF Industry News

31 October 2023

FATF Consultation on Beneficial Ownership and Transparency

AML/CTF/CPF Industry News

27 October 2023

Plenary Outcomes Published by FATF

Compass AML/CTF/CPF Industry News

26 October 2023

Failure to Prevent Fraud Introduced

Fraud Advisory and Transformation Industry News

24 October 2023

RUSI Publishes Brief on AML Supervision of Legal, Accountancy Sectors

AML/CTF/CPF Industry News

21 October 2023

FATF Adds Three Countries to its Black List

AML/CTF/CPF Industry News

18 October 2023

SRA Releases Guidance for Firms in Scope of the MLRs 2017

AML/CTF/CPF Industry News

13 October 2023

JMLSG Approval on Material Published in the Last Twelve Months

Advisory and Transformation AML/CTF/CPF Industry News

13 October 2023

AML Report for 2022-23 by SRA

Sanctions AML/CTF/CPF Industry News

13 October 2023

JMLSG Publishes Updates Guidance

RegSight AML/CTF/CPF Industry News

12 October 2023

HKMA Publishes Circular on Combating Digital Fraud

Fraud Advisory and Transformation Industry News

11 October 2023

Germany Announces New Federal Financial Agency

AML/CTF/CPF Industry News

07 October 2023

IMF's Paper on Cryptoasset policies

Digital Assets Fraud Digital Assets/Crypto AML/CTF/CPF

07 October 2023

IMF's Paper on Cryptoasset policies

06 October 2023

PSFA Publishes its Fraud Control Testing Framework

Fraud Advisory and Transformation Industry News

06 October 2023

European Commission Updates FAQs on Sanctions

Sanctions Industry News

03 October 2023

EBA Outlines its 2024 work programme

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

29 September 2023

OFSI Publishes Correspondent Banking General Licence

Retail Banking AML/CTF/CPF Corporate Finance Industry News

29 September 2023

Wolfsberg Group Responds to HM Treasury AML/CTF Consultation

AML/CTF/CPF Industry News

27 September 2023

Mutual Evaluation Report for Luxembourg

AML/CTF/CPF Industry News

27 September 2023

Europol Publishes Report on Financial and Economic Crime

Fraud AML/CTF/CPF Industry News

25 September 2023

HKMA Releases Second Edition of Report on AML/CTF RegTech

Fraud AML/CTF/CPF Industry News FCC Software Products

19 September 2023

Global Anti-Scam Alliance Releases Results of UK Survey

Fraud Industry News

19 September 2023

MAS Published its Fourth Enforcement Report

Market Abuse AML/CTF/CPF Industry News

19 September 2023

Wolfsberg Group Updates its Payment Transparency Standards

AML/CTF/CPF Industry News

07 September 2023

JMLSG Revises Cryptoassets Guidance

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

07 September 2023

PLENITUDE INSIGHTS: The Ongoing Fight Against Modern Slavery

Plenitude Insights Advisory and Transformation

06 September 2023

FCA's Assessment on the Sanctions System

Sanctions Advisory and Transformation Industry News

05 September 2023

FCA Launches PEP Treatment Review

AML/CTF/CPF Industry News

04 September 2023

Asia Pacific Group Published Tax Crimes Typology Report

Tax Evasion Industry News

31 August 2023

MAS Circular on Sanctions Related Risks Detection

Sanctions Industry News

30 August 2023

MAS Publishes Paper on Strengthening AML/CTF Controls

AML/CTF/CPF Industry News

29 August 2023

Wolfsberg Group Responds to EBA ML/TF Risk Factors

AML/CTF/CPF Industry News

24 August 2023

Money Laundering Risk Analysis Guidance by FINMA

Advisory and Transformation AML/CTF/CPF

24 August 2023

Money Laundering Risk Analysis Guidance by FINMA

18 August 2023

Wolfsberg Group Response to FATF paper on NPO Abuse

AML/CTF/CPF Industry News

15 August 2023

Singapore's Stablecoin Regulatory Framework

Digital Assets Digital Assets/Crypto Industry News

15 August 2023

PSR Publishes APP Fraud Consultation Documents

Fraud EMI/PSP/Fintech Industry News

11 August 2023

PLENITUDE INSIGHTS: Account Access and Closure

Plenitude Insights Retail Banking Advisory and Transformation AML/CTF/CPF EMI/PSP/Fintech

04 August 2023

Egmont Group Publishes 21-22 Annual Report

Fraud AML/CTF/CPF Industry News

02 August 2023

UK Plans to Ban Cold Calling on All Financial Services and Products

Fraud Industry News

31 July 2023

SEC Risk Alert on Broker-Dealers Deficiencies in AML Compliance

AML/CTF/CPF Industry News

30 July 2023

PSFA 23-24 Delivery Plan Published

Fraud Industry News

30 July 2023

MAS's Paper on Single Family Offices

Advisory and Transformation AML/CTF/CPF Wealth Management & Private Banking

30 July 2023

MAS's Paper on Single Family Offices

28 July 2023

The Consumer Duty will be in Force on 31st July

Advisory and Transformation AML/CTF/CPF Industry News

28 July 2023

SRA Publishes its ML/TF Risk Assessment

Advisory and Transformation AML/CTF/CPF Industry News

21 July 2023

PLENITUDE INSIGHTS: It's Your Duty to Be (Consumer) Dutiful

18 July 2023

SFO Annual Report for 2022-23

Fraud Advisory and Transformation Industry News

18 July 2023

National Strategic Assessment for Serious and Organised Crime

Fraud AML/CTF/CPF Industry News

17 July 2023

FSB Publishes Final Report on Cryptoassets

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

12 July 2023

EBA Publishes Fourth Opinion on ML/TF Risks in EU

AML/CTF/CPF Industry News

11 July 2023

EBA Publishes Report on AML/CTF Approaches

Retail Banking Advisory and Transformation AML/CTF/CPF Industry News

06 July 2023

MONEYVAL's Typologies Report on ML/TF Risks in Virtual Assets

Digital Assets Digital Assets/Crypto AML/CTF/CPF

03 July 2023

PLENITUDE INSIGHTS: Navigating the Travel Rule

03 July 2023

PLENITUDE INSIGHTS: Navigating the Travel Rule

30 June 2023

PF Risk Assessment Guide Published

Advisory and Transformation AML/CTF/CPF Industry News

30 June 2023

Amendments on the Economic Crime Supervision Handbook Published

Advisory and Transformation AML/CTF/CPF Industry News

30 June 2023

Report on UK's Cryptocurrency Vision

Digital Assets Digital Assets/Crypto EMI/PSP/Fintech Industry News

30 June 2023

Report on the Abuse of Virtual Assets for Terrorism Financing

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

30 June 2023

UK Gov's Consultation on Reform of AML/CTF Supervisory System

AML/CTF/CPF Industry News

30 June 2023

Guidance on Higher Quality SARs

AML/CTF/CPF Industry News

23 June 2023

Outcomes from FATF Plenary

AML/CTF/CPF Industry News

20 June 2023

Hong Kong Launches Information Sharing Platform

Fraud AML/CTF/CPF Wealth Management & Private Banking Corporate Finance Industry News

19 June 2023

UK Maritime Services Ban and Oil Price Cap Exception Industry Guidance

Sanctions Advisory and Transformation Industry News

19 June 2023

AMF's Paper on Decentralised Finance

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

15 June 2023

EBA Publishes Payment Institutions ML/TF Risks Report

Advisory and Transformation AML/CTF/CPF EMI/PSP/Fintech Industry News

14 June 2023

MONEYVAL Annual Report on AML/CTF

AML/CTF/CPF Industry News

07 June 2023

FCA's Policy Statement on Cryptoassets

Digital Assets Digital Assets/Crypto Industry News

07 June 2023

WEBINAR: Compliance for Crypto Activities, Same but Different

Plenitude News Digital Assets Digital Assets/Crypto AML/CTF/CPF

02 June 2023

JMLSG Publishes Revision

Advisory and Transformation AML/CTF/CPF Industry News

01 June 2023

New VASPs Licencing Regime for Hong Kong

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

31 May 2023

PLENITUDE INSIGHTS: Demystifying the CASP Registration Process

Plenitude Insights Digital Assets Digital Assets/Crypto AML/CTF/CPF

31 May 2023

EBA Extends ML/TF Risks to Crypto

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

30 May 2023

'SARs in Action' Published by UKFIU

Fraud Advisory and Transformation Industry News

26 May 2023

MAS Guidance on FIs' CTF Controls

AML/CTF/CPF Industry News

25 May 2023

UK Publishes Insider Dealing Legislation

Market Abuse Advisory and Transformation Industry News

23 May 2023

Hong Kong's SFC Publishes Consultation on VATPs

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

12 May 2023

UK Finance's Annual Fraud Report for 2022

Fraud Advisory and Transformation Industry News

12 May 2023

IMF Publishes new CTF Practices

AML/CTF/CPF Industry News

30 April 2023

Illicit Finance Risk Assessment of DeFi Published for the First Time

Sanctions Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

30 April 2023

US Treasury Derisking Strategy for 2023

Advisory and Transformation AML/CTF/CPF Industry News

26 April 2023

UK Releases a New Global Anti-corruption Sanctions Regime

Sanctions Bribery & Corruption Industry News

25 April 2023

EU Publishes Strategy on Combating ML/TF

AML/CTF/CPF Industry News

21 April 2023

FinCEN Releases 2022 Year in Review

AML/CTF/CPF Industry News

20 April 2023

Regulatory Framework for Cryptoassets Introduced in the EU

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

20 April 2023

PLENITUDE NEWS: Promotions 2023

Plenitude News

17 April 2023

Guidance Provided on Beneficial Ownership Reporting

Sanctions Digital Assets Digital Assets/Crypto AML/CTF/CPF

17 April 2023

Guidance Provided on Beneficial Ownership Reporting

17 April 2023

AB&C Compliance Programme Guidance Updated

Bribery & Corruption Industry News

12 April 2023

New Sanctions on Russian Oligarchs Imposed on the UK

Sanctions Industry News

10 April 2023

UK Publishes Economic Crime Plan 2

Fraud Advisory and Transformation AML/CTF/CPF Industry News

10 April 2023

Revised Guidelines on ML/TF Risk Factors Released by EBA

Advisory and Transformation AML/CTF/CPF EMI/PSP/Fintech Corporate Finance Industry News

04 April 2023

FCA Publishes 2023-24 Business Plan

Fraud AML/CTF/CPF Industry News

03 April 2023

JMLSG Publishes Amendments to Part II

Asset Management AML/CTF/CPF Industry News Pensions

01 April 2023

MAS Launches New Digital Platform to Securely Share Information

AML/CTF/CPF Industry News

31 March 2023

PSR Annual Report for 2022-23

Fraud Digital Assets/Crypto AML/CTF/CPF EMI/PSP/Fintech Industry News

31 March 2023

EBA Issues New Guidelines on Customer Access to Financial Services

Advisory and Transformation AML/CTF/CPF Industry News

31 March 2023

March Edition of SAR Booklet Published by UKFIU

AML/CTF/CPF Industry News

31 March 2023

FCA Annual Report for 2022-23

Fraud AML/CTF/CPF Industry News

28 March 2023

EU Approves New AML/CTF Measures

Advisory and Transformation AML/CTF/CPF Industry News

27 March 2023

UK and EU Sign MOU on Financial Services

Market Abuse AML/CTF/CPF

27 March 2023

UK and EU Sign MOU on Financial Services

27 March 2023

HKMA Circular on Customer Onboarding

Digital Assets/Crypto Advisory and Transformation AML/CTF/CPF Corporate Finance Industry News

16 March 2023

FCA Publishes a Dear CEO Letter to Payment Firms

Sanctions Advisory and Transformation AML/CTF/CPF EMI/PSP/Fintech

16 March 2023

FCA Publishes a Dear CEO Letter to Payment Firms

14 March 2023

OFSI Annual Review for 2022-23

Sanctions Industry News

10 March 2023

Final Amendments to JMLSG Part I and Part II Published

AML/CTF/CPF Industry News

10 March 2023

New Guidance on Beneficial Ownership Published

AML/CTF/CPF Industry News

09 March 2023

Policy Paper on the Economic Crime Levy Published

AML/CTF/CPF Industry News

09 March 2023

REPO Task Force on Sanctions Evasion

Sanctions Industry News

07 March 2023

PLENITUDE INSIGHTS: Reframing the Lens of Economic Crime

Plenitude Insights Advisory and Transformation

03 March 2023

MAS's Circular on ML/TF Risks in Wealth Management

Advisory and Transformation AML/CTF/CPF Wealth Management & Private Banking Industry News

25 February 2023

10th EU Sanctions Package Announced

Sanctions Industry News

24 February 2023

Key Takeaways from FATF Plenary

Sanctions AML/CTF/CPF Industry News

23 February 2023

OFSI Updates Guidance on Monetary Penalties for Breaches of Sanctions

Sanctions Advisory and Transformation Industry News

Industry News

23 February 2023

OFSI Updates Guidance on Monetary Penalties for Breaches of Sanctions

20 February 2023

HK Publishes Guidance on Transaction Monitoring Screening

Fraud AML/CTF/CPF Industry News

18 February 2023

AUSTRAC Signs Memorandum with UK

AML/CTF/CPF Industry News

10 February 2023

Money Laundering Regulations 2023 Published

Fraud RegSight AML/CTF/CPF Industry News

09 February 2023

Plenitude Launches RegSight: A FCC Obligations Management Solution

Plenitude News RegSight

08 February 2023

WEBINAR: Crypto Regulations

Plenitude News Digital Assets Digital Assets/Crypto AML/CTF/CPF

06 February 2023

Cryptoasset Firms Must Comply with UK Financial Promotion Regime

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

03 February 2023

FCA Publishes Dear CEO Letters on Consumer Duty

Asset Management Retail Banking EMI/PSP/Fintech Industry News Insurance

03 February 2023

Wolfsberg Group Publishes Updated Iterations of CBDDQ and FCCQ

Advisory and Transformation AML/CTF/CPF Industry News

01 February 2023

HM Treasure Publishes Digital Assets Policy Announcement

Digital Assets Digital Assets/Crypto Industry News

27 January 2023

Biden Administration's Roadmap to Mitigate Cryptocurrency's Risks

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

24 January 2023

Annual Report on SARs Published by NCA

AML/CTF/CPF Industry News

16 January 2023

HK Passes Amendments to AML/CTF Bill

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

13 January 2023

FCA Fines 2022

Advisory and Transformation AML/CTF/CPF Bribery & Corruption Industry News

11 January 2023

PLENITUDE INSIGHTS: UK RegSight 2022 Regulatory Recap

Plenitude Insights Sanctions RegSight AML/CTF/CPF

05 January 2023

Threshold Under POCA Rises

AML/CTF/CPF Industry News

14 December 2022

OFSI Annual Review 2021-22

Sanctions Industry News

13 December 2022

WEBINAR Crypto: Opportunities and Effective Risk Management

Plenitude News Digital Assets Digital Assets/Crypto AML/CTF/CPF

01 December 2022

PLENITUDE INSIGHTS: Crypto compliance solutions

Plenitude Insights Digital Assets Digital Assets/Crypto AML/CTF/CPF

22 November 2022

PLENITUDE NEWS: Plenitude Joins ADAN

Plenitude News Digital Assets Advisory and Transformation

22 November 2022

UK, Singapore Issue Paper on Global Regulatory Approach to FinTech

AML/CTF/CPF EMI/PSP/Fintech Industry News

22 November 2022

EBA Published Guidelines on Remote Customer Onboarding

AML/CTF/CPF Industry News

21 November 2022

Plenitude expands leadership team with Mark Humphries appointment

Plenitude News

21 November 2022

Guidance for MSBs Published by HMRC

AML/CTF/CPF EMI/PSP/Fintech Industry News

16 November 2022

PLENITUDE INSIGHTS: Integrate Proliferation Financing into Risk Control

Plenitude Insights AML/CTF/CPF

Plenitude Insights

16 November 2022

PLENITUDE INSIGHTS: Integrate Proliferation Financing into Risk Control

16 November 2022

UK Law Commission Seeks Knowledge on DAOs

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

14 November 2022

JMLSG Proposes Amendments to Part II

Digital Assets Digital Assets/Crypto Capital Markets/Investment Banking Advisory and Transformation AML/CTF/CPF Wealth Management & Private Banking Industry News

14 November 2022

Annual Review Published by OFSI

Sanctions Industry News

24 October 2022

PLENITUDE INSIGHTS : Reflections From Orel Garcia, Junior Consultant

Plenitude Insights Advisory and Transformation

Plenitude Insights

24 October 2022

PLENITUDE INSIGHTS : Reflections From Orel Garcia, Junior Consultant

18 October 2022

PLENITUDE INSIGHTS: Crypto - Understanding the Opportunities and Risks

Plenitude Insights Digital Assets Digital Assets/Crypto

Plenitude Insights

18 October 2022

PLENITUDE INSIGHTS: Crypto - Understanding the Opportunities and Risks

17 October 2022

AUSTRAC Guidance on Source of Wealth Checks

AML/CTF/CPF Industry News

17 October 2022

PLENITUDE INSIGHTS: EU Equivalence after Brexit

Plenitude Insights Capital Markets/Investment Banking RegSight AML/CTF/CPF

17 October 2022

WEBINAR: Assessing Your Risk Exposure to Proliferation Financing

Plenitude News Sanctions Advisory and Transformation AML/CTF/CPF

17 October 2022

OFAC and OFSI to Enhance Sanctions Implementation Support

Sanctions Industry News

07 October 2022

PLENITUDE NEWS: Mid-Year Promotions 2022

Plenitude News Advisory and Transformation

07 October 2022

Singapore Publishes New Strategy to Combat TF

AML/CTF/CPF Industry News

07 October 2022

IMF Publishes Guidance on Beneficial Ownership

AML/CTF/CPF Industry News

06 October 2022

Plenitude Expands Leadership Team with Mike Coates Appointment

Plenitude News

04 October 2022

PLENITUDE INSIGHTS: Challenges in Customer Risk Assessment

Plenitude Insights ClientSight AML/CTF/CPF

01 October 2022

SRA Publishes Annual AML Report

AML/CTF/CPF Industry News

30 September 2022

PLENITUDE INSIGHTS: Black History Month

30 September 2022

PLENITUDE INSIGHTS: Black History Month

26 September 2022

JMLSG Updates Part I to align with changes in MLRs 2022

AML/CTF/CPF Industry News

22 September 2022

FinCEN Issues Final Rule on Beneficial Onwership Reporting

AML/CTF/CPF Industry News

30 August 2022

New Sanctions Obligations for Cryptoassets businesses

Sanctions Digital Assets Digital Assets/Crypto Industry News

23 August 2022

Wolfsberg Group's Paper on RFIs for Transaction Monitoring

AML/CTF/CPF Industry News

01 August 2022

UK Introduces New Sanctions Measures

Sanctions Digital Assets Digital Assets/Crypto Industry News

30 July 2022

Latest Hong Kong ML/TF Risk Assessment Report

Advisory and Transformation AML/CTF/CPF Industry News

18 July 2022

NCA Issues Red Alert on Financial Sanctions Evasion Typologies

Sanctions Industry News

14 July 2022

Plenitude Receives Strategic Investment from Growth Capital

Plenitude News

11 July 2022

PLENITUDE INSIGHTS: Additional Sanctions Imposed on Belarus

Plenitude Insights Sanctions Compass

07 July 2022

US Treasury's Framework for International Engagement on Digital Assets

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

30 June 2022

New Bill Ensuring Safe Crypto Transfers

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

21 June 2022

Wolfsberg Publication on Private Public Partnerships

AML/CTF/CPF Industry News

16 June 2022

Plenitude Launches ClientSight: A FCC Client Risk Rating Solution

Plenitude News ClientSight AML/CTF/CPF

01 June 2022

Updated Standards from FATF on VAs and VASPs

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

30 May 2022

UK Tax Justice Network Releases Final Secrecy Index for 2022

Tax Evasion Compass AML/CTF/CPF Industry News

30 May 2022

Joint ESA's Report on Removing Licences for Serious AML/CTF Breaches

AML/CTF/CPF Industry News

30 May 2022

FATF Mutual Evaluation Report on France

AML/CTF/CPF Industry News

11 May 2022

Wolfsberg Group Publishes FAQs on Adverse Media Screening

AML/CTF/CPF Industry News

01 May 2022

FATF Reports on UK's Progress on its Technical Compliance Deficiencies

AML/CTF/CPF Industry News

30 April 2022

New Paper on FIs Name Screening Approach Outlined by MAS

Advisory and Transformation AML/CTF/CPF

30 April 2022

New Paper on FIs Name Screening Approach Outlined by MAS

26 April 2022

Principle 11 Update Issued by FCA

Sanctions Industry News

07 April 2022

FCA's 2022-23 Business Plan

AML/CTF/CPF Industry News

05 April 2022

Wolfsberg Group Publishes New Guidance on Risk Management.

AML/CTF/CPF Industry News

01 April 2022

PLENITUDE NEWS: 2022 Promotions

Plenitude News Advisory and Transformation

30 March 2022

UAE Added to FATF's Gray List

AML/CTF/CPF Industry News

29 March 2022

Updated Jurisdictions under Increased Monitoring Issued by FATF

AML/CTF/CPF Industry News

17 March 2022

PLENITUDE NEWS: Senior Executive Promotion

Plenitude News Advisory and Transformation

15 March 2022

INTERPOL Launches new financial crime and anti-corruption centre

Bribery & Corruption Industry News

01 March 2022

Joint Statement from OFSI, HMRC, FCA on UK Sanctions Compliance

Sanctions Digital Assets Digital Assets/Crypto Industry News

01 March 2022

PLENITUDE INSIGHTS: Ukraine Crisis and New Russia Sanctions

Plenitude Insights Sanctions Advisory and Transformation

01 March 2022

MLRs 2017 Time Limit for Trust Registration Extended

RegSight AML/CTF/CPF Industry News

28 February 2022

UK Unveils Plan to Upgrade Companies House

Advisory and Transformation AML/CTF/CPF Industry News

14 February 2022

EBA Publishes New Guidelines on Role of AML/CTF Compliance Officers

Advisory and Transformation AML/CTF/CPF Industry News

13 February 2022

JMLSG Publishes Amendments on Monitoring of Customer Activities

AML/CTF/CPF Industry News

31 January 2022

FATF Publishes Annual Report for 2021-22

AML/CTF/CPF Industry News

31 January 2022

EBA Launches EuReCA

AML/CTF/CPF Industry News

22 November 2021

Wolfsberg Group Endorses Guiding Principle for ISO20022

AML/CTF/CPF EMI/PSP/Fintech Industry News

04 November 2021

PLENITUDE NEWS: Mid-Year promotions 2021

Plenitude News Advisory and Transformation

08 October 2021

HMRC Issues New AML/CTF Guidance for TCSP

Advisory and Transformation AML/CTF/CPF Industry News

30 September 2021

PLENITUDE INSIGHTS: Navigating the Path to Respectability

Plenitude Insights Sanctions Digital Assets Digital Assets/Crypto AML/CTF/CPF

30 July 2021

PLENITUDE INSIGHT: COVID-19 Impact Assessment

Plenitude Insights Fraud Advisory and Transformation AML/CTF/CPF

14 July 2021

FCA Publishes 2021-22 Business Plan

AML/CTF/CPF Industry News

13 July 2021

PLENITUDE INSIGHTS: InCompliance - A finger on the Pulse

Plenitude Insights Advisory and Transformation AML/CTF/CPF

12 July 2021

PLENITUDE INSIGHTS: Sanctions on Mainland China

Plenitude Insights Sanctions Advisory and Transformation

07 July 2021

PLENITUDE INSIGHTS: The Unrelenting Pace of Legislative Development

Plenitude Insights Sanctions RegSight AML/CTF/CPF

01 July 2021

FATF Report on Opportunities and Challenges of New Technologies in AML

AML/CTF/CPF Industry News FCC Software Products

30 June 2021

FinCEN Issues US Priorities for AML/CTF Policy

AML/CTF/CPF Industry News

30 June 2021

PLENITUDE NEWS: Listen to the Latest Episode of StreetTalksTo

Plenitude News Digital Assets Digital Assets/Crypto

17 June 2021

AUSTRAC Releases Guidance Following Reforms to AML/CTF

Advisory and Transformation AML/CTF/CPF Industry News

17 June 2021

PLENITUDE INSIGHT: EBA Euro Commission Consultation on Supervisors

Plenitude Insights Advisory and Transformation AML/CTF/CPF

15 June 2021

PLENITUDE INSIGHTS: EU Plans for Overhaul on AML Controls

Plenitude Insights Advisory and Transformation AML/CTF/CPF

08 June 2021

EBA Opinion for ML/TF Risks for Investment Firms

Plenitude Insights Capital Markets/Investment Banking Advisory and Transformation AML/CTF/CPF

03 June 2021

Wolfsberg Group on how FIs can Demonstrate AML/CTF efficiency

Advisory and Transformation AML/CTF/CPF Industry News

02 June 2021

PLENITUDE INSIGHTS: UK Human Right Sanctions Regime

Plenitude Insights Sanctions Advisory and Transformation

01 June 2021

EU Launches New European Tax Observatory

Tax Evasion Industry News

14 May 2021

WEBINAR: The Signal and the Noise - Are Cryptoassets Risky?

Plenitude News Digital Assets Digital Assets/Crypto AML/CTF/CPF

13 May 2021

PLENITUDE INSIGHTS: Biden Administration Announces Sweeping Measures

Plenitude Insights Sanctions

12 May 2021

HKMA Publishes Good Practices on AML/CTF Controls

Retail Banking AML/CTF/CPF Industry News

08 May 2021

PLENITUDE INSIGHTS: Cryptoassets - Economic Crime Threats and Risks

Plenitude Insights Digital Assets Digital Assets/Crypto AML/CTF/CPF

06 May 2021

PLENITUDE INSIGHTS: COVID-19 Digital Transformations in FCC

Plenitude Insights Fraud Technology & Data Analytics AML/CTF/CPF

29 April 2021

PLENITUDE INSIGHTS: EBA Opinion on ML/TF Risk for Banking Institutions

Plenitude Insights Retail Banking Advisory and Transformation AML/CTF/CPF

Plenitude Insights

29 April 2021

PLENITUDE INSIGHTS: EBA Opinion on ML/TF Risk for Banking Institutions

23 April 2021

VASPs in Ireland Subject to AML/CTF Regulations for the First Time

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

31 March 2021

PLENITUDE INSIGHT: EBA opinion for ML/TF for Life Insurance

Plenitude Insights Advisory and Transformation AML/CTF/CPF

30 March 2021

Changes to Organisations Subject to Annual Financial Crime Reporting

Digital Assets Digital Assets/Crypto AML/CTF/CPF Industry News

23 March 2021

PLENITUDE NEWS: Senior Advisor Appointment

Plenitude News

22 March 2021

PLENITUDE INSIGHTS: COVID-19 Impact Assessment

Plenitude Insights Fraud Advisory and Transformation AML/CTF/CPF

16 March 2021

FCA Launches Criminal Proceedings against NatWest

Retail Banking AML/CTF/CPF Industry News

17 February 2021

Plenitude Announces UK Finance Associate Membership

Plenitude News AML/CTF/CPF

01 February 2021

PLENITUDE INSIGHTS: Post-Brexit Reach of UK and EU Regimes

Plenitude Insights Sanctions FCC Software Products

26 January 2021

PLENITUDE INSIGHTS: Opinion on FCA's Dear CEO Letter to Retail Banks

Plenitude Insights Retail Banking RegSight AML/CTF/CPF

Plenitude Insights

26 January 2021

PLENITUDE INSIGHTS: Opinion on FCA's Dear CEO Letter to Retail Banks

05 January 2021

China Says US Sanctions Have No Legal Effect in Hong Kong or China

Sanctions Industry News

15 November 2020

PLENITUDE NEWS: ISO27001 Certification

Plenitude News

20 September 2020

PLENITUDE NEWS: Senior Executive Promotions

Plenitude News

17 September 2020

FATF Issued New Binding AML/CTF Standards for Virtual Assets

Plenitude Insights Digital Assets Digital Assets/Crypto AML/CTF/CPF

02 September 2020

PLENITUDE NEWS: ISO9001 certification

Plenitude News

27 July 2020

FCA Launches Enhanced Financial Services Register to Protect Consumers

AML/CTF/CPF Industry News

30 January 2020

PLENITUDE INSIGHTS: Financial Crime Risk Assessment in Law Firms

Plenitude Insights Advisory and Transformation AML/CTF/CPF

29 July 2019

PLENITUDE INSIGHTS: 6MLD and Its Implications

Plenitude Insights Advisory and Transformation AML/CTF/CPF

21 June 2019

PLENITUDE INSIGHTS: DNFBPs and Financial Crime

Advisory and Transformation AML/CTF/CPF

21 June 2019

PLENITUDE INSIGHTS: DNFBPs and Financial Crime

13 March 2019

PLENITUDE NEWS: Paris Office Opening

Plenitude News Advisory and Transformation

29 October 2018

PLENITUDE INSIGHTS: FCC Target Operating Model and Transformation

Plenitude Insights Retail Banking Advisory and Transformation AML/CTF/CPF Insurance

Plenitude Insights

29 October 2018

PLENITUDE INSIGHTS: FCC Target Operating Model and Transformation

17 October 2018

PLENITUDE INSIGHTS: Cryptoassets and Financial Crime

Plenitude Insights Digital Assets Digital Assets/Crypto AML/CTF/CPF

No results found…

Get in touch to speak to the team or to request a demo

Our best-in-class team are committed to building a secure financial system, safeguarding society, and empowering our clients to meet their regulatory obligations.

Contact Us

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(1).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(2).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(3).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(4).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(5).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(6).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(7).jpg)