Managing financial crime obligations – the challenge

Demonstrating that a financial services organisation is actively fulfilling its Financial Crime Compliance (FCC) obligations is now a commercial and social necessity.

Failing to meet FCC obligations drastically heightens your organisation’s risk of regulatory enforcement, hefty fines, reputational damage and loss of investor confidence.

Despite this exposure, many financial institutions either do not have in place a comprehensive Obligations Register or maintain a solution that adds complexity and unnecessary costs.

RegSight is the simplest and most effective online solution to manage your FCC obligations, and provides assurance that your organisation is meeting applicable obligations. We provide clients with the relevant obligations and a monthly horizon scanning service, scanning 200+ legal and regulatory sources to inform and prepare them for changes to financial crime laws, regulations and guidance.

Key features of RegSight

Plenitude RegSight is the simplest, most effective solution for managing your FCC obligations, ensuring your organisation meets all applicable requirements amid rising regulations and increased scrutiny.-

Comprehensive register of financial crime compliance obligations

-

Powerful search capability

-

Built-in self-assessment and gap analysis functionality

-

Management reporting

-

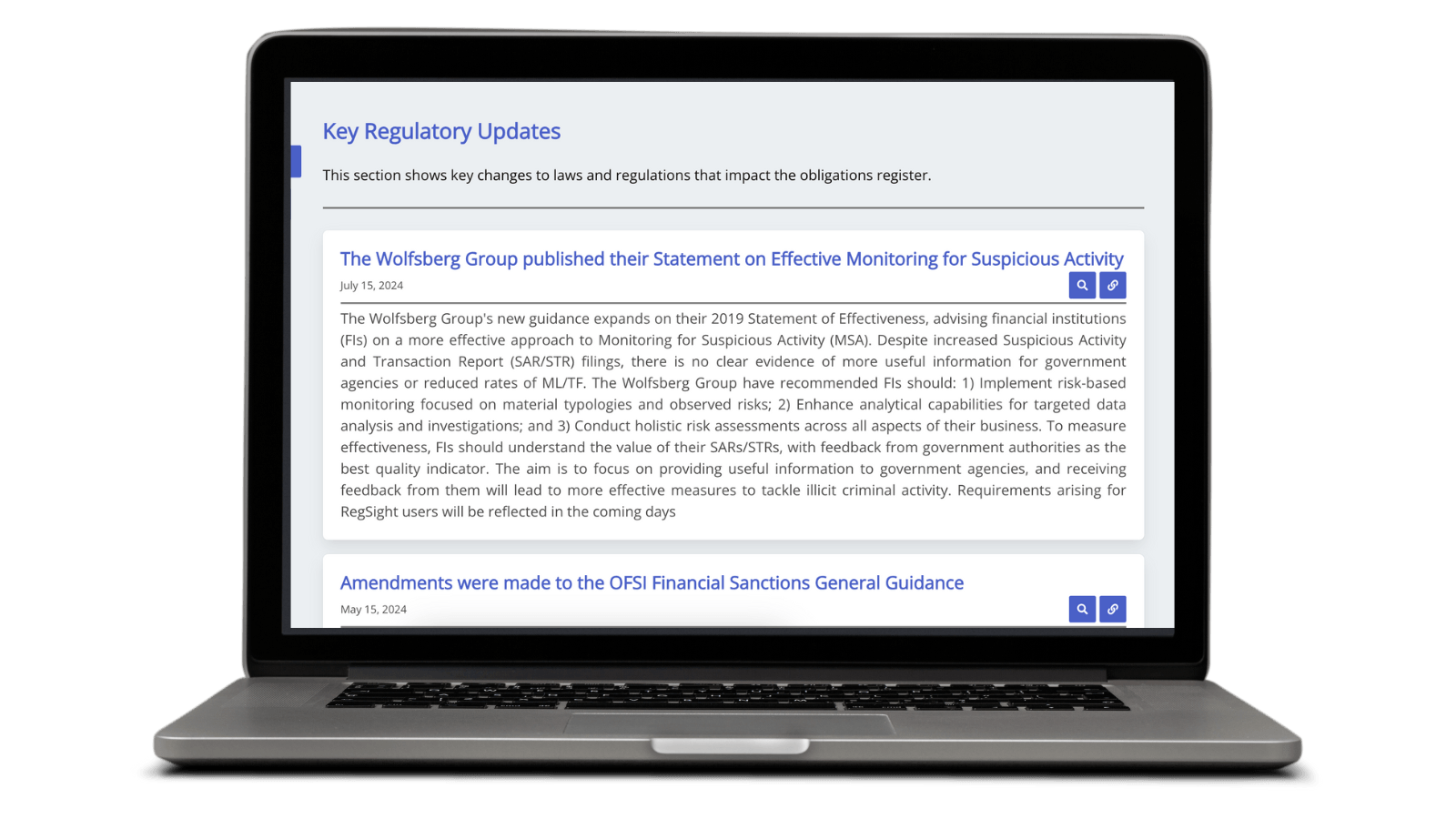

Monthly updates and horizon scanning

-

Intuitive interface

Obligations Register Scope

We’ve built Obligations Registers for major financial centres worldwide, covering multiple risk types. Our expertise and methodology allow us to create registers for any risk type in any jurisdiction.

Questions financial institutions should ask

-

Can you prove to the regulator that your policy framework fully complies with all applicable laws, regulations and guidance, with complete traceability across all policies and standards?

-

How do you keep up with every regulatory update? Have you ever scrambled to implement new obligations because of late identification?

-

Can you instantly identify which policy documents are affected by new regulations and implement the necessary changes?

-

How much are you currently spending on resources to manage obligations and conduct horizon scanning? In this cost-conscious environment could you benefit from demonstrating a cost reduction to senior management?

-

As an accountable individual, are you worried about your current approach to obligations management? Could you miss something critical? How do you tackle this concern?

Related articles

Plenitude Insights

11 January 2024

PLENITUDE INSIGHTS: RegIntel - 2023 Recap and 2024 Outlook Report

Get in touch to speak to the team or to request a demo

Our best-in-class team are committed to building a secure financial system, safeguarding society, and empowering our clients to meet their regulatory obligations.

Contact Us

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(1).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(2).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(3).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(4).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(5).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(6).jpg)

.jpg?width=400&height=147&name=plenitude%20Affiliation%20Logos%20(7).jpg)